Italy sees falling mortgage rates, yet loan requests from households are dwindling. Explore the ABI’s latest report and future trends.

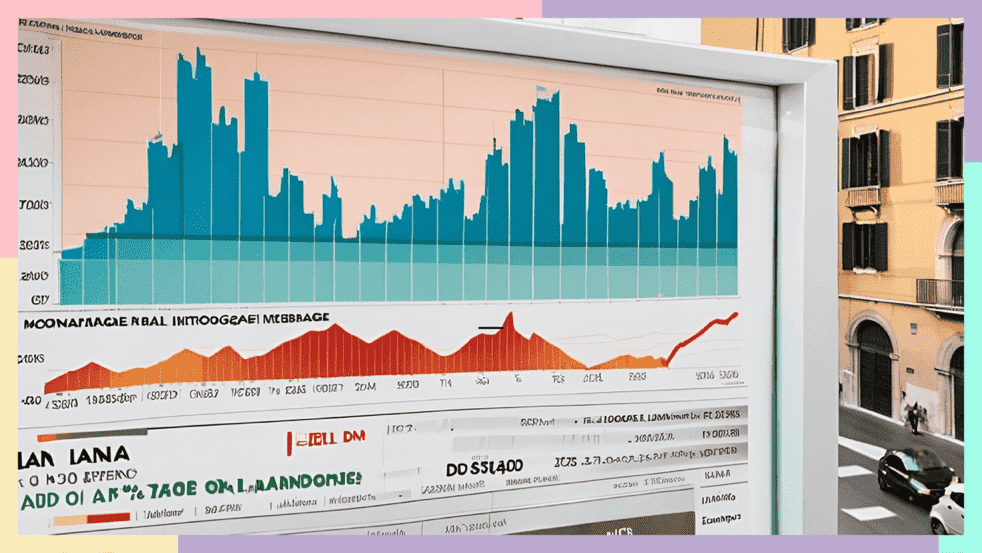

Italy is currently witnessing a paradoxical trend in its mortgage landscape: while mortgage rates are on a downward trajectory, the appetite for loans among households appears to be waning. The latest report from the ABI indicates a notable decline in mortgage rates, with expectations for further reductions in December. Specifically, the average rate for new home purchase transactions has dipped to 3.23%, a slight decrease from 3.27% in October 2024 and a significant drop from 4.42% in December 2023.

This data, however, reflects the situation prior to the recent 25 basis point cut implemented by the European Central Bank (ECB) this week. In the early days of December, the three-month Euribor rate averaged 2.88%, a decrease of 13 basis points from November’s 3.01% and a staggering reduction of 112 basis points from the peak observed in October 2023. Similarly, the six-month BOT rate has also experienced a decline, averaging 2.69%, down 10 basis points from November and 136 basis points from its October high.

Moreover, the ten-year IRS rate, which is frequently utilized in mortgage calculations, averaged 2.15%, reflecting an 18 basis point drop from November and a notable 138 basis point decrease from the previous October’s peak. The average rate on ten-year BTPs has also fallen to 3.23%, down from 3.56% in November, marking a reduction of 33 basis points and an overall decline of 176 basis points from the October 2023 high.

Despite these favorable shifts in rates, the demand for loans is paradoxically diminishing. In November 2024, loans to both businesses and households decreased by 1.6% compared to the previous year, with a 3.1% decline in business loans and a 0.2% drop in household loans recorded in October 2024. The ABI attributes this decline in credit volumes to a slowdown in economic growth, which has inevitably dampened the demand for loans. However, the question arises: is the economic slowdown the sole culprit behind this dwindling demand?

According to Unimpresa, the situation is more nuanced. The persistently high rates applied to business credit—nearly tripling since 2021, when the average rate stood at a mere 1.36%—are also a significant factor. Despite the recent rate cuts, Unimpresa posits that these adjustments could potentially stimulate further reductions, providing much-needed relief to Italian enterprises that have endured years of escalating credit costs.

The overarching narrative suggests that credit remains prohibitively expensive, stifling long-term investments and exacerbating financial pressures, particularly for small and medium-sized enterprises (SMEs). Loans below €1 million are particularly affected, as they carry higher rates due to perceived risks, although a gradual decline has been noted in 2024. Even ten-year loan installments, while slightly reduced from their 2023 peaks, continue to hover above pre-2022 levels, underscoring the prevailing unfavorable credit environment.

Italy’s mortgage market is caught in a curious conundrum: as rates fall, the demand for loans diminishes, leaving many to ponder the intricate interplay of economic factors at play.