Best US Real Estate Investment Markets Revealed

Discover the best investor opportunities in Florida, North Carolina, and Texas. Explore the best US real estate investment markets today!

Based on a comprehensive analysis of annual price growth, personal income trajectories, and demographic expansion, Florida has solidified its status as a premier market for real estate investors, as delineated by Agent Advice. The report further identifies major urban centers in North Carolina and Texas as equally promising for investment opportunities. Notably, certain markets—particularly those situated in Texas and Arizona—have experienced significant declines in home prices from their zenith.

Florida, North Carolina, and Texas emerge as the dominant players in a recent report evaluating the ten best US real estate investment markets. Like their counterparts in the broader housing market, real estate investors have navigated the tumultuous ebbs and flows of market dynamics. While investor engagement remained robust through the conclusion of 2023, sentiment among investors took a downturn throughout much of 2024.

For those undeterred by market fluctuations and actively seeking lucrative opportunities, Agent Advice—an agent platform established by industry luminary Chris Heller, previously affiliated with OJO Labs and Keller Williams—has meticulously ranked several markets based on a confluence of metrics, including annual home price growth, population growth, personal income, and income growth.

The findings unequivocally indicate that the Southern United States is a veritable goldmine for investors. Among the ten most favorable markets, four are located in Florida, with two each in North Carolina and Texas. The cities that have been heralded as the most advantageous for investors include:

- Miami, Florida

- Tampa, Florida

- Charlotte, North Carolina

- Raleigh, North Carolina

- Phoenix, Arizona

- Orlando, Florida

- Austin, Texas

- Nashville, Tennessee

- Dallas, Texas

- Jacksonville, Florida

While other cities on the list excelled in specific metrics such as annual price growth and personal income, Miami's cumulative score secured its position at the pinnacle. Phoenix, for instance, led the charge in annual price growth for one-bedroom units, boasting an impressive 11.5% year-over-year increase, while Tampa, Charlotte, and Raleigh each reported annual price growth exceeding 10%. Concurrently, Nashville distinguished itself with a commendable personal income growth rate of 5%.

However, it is imperative to acknowledge that Florida and Texas markets are not without their inherent risks. Despite Agent Advice's ranking of these pandemic-era hotspots as the crème de la crème, recent indicators suggest a cooling trend in several of these locales. Cities such as Austin, Dallas, and Phoenix have witnessed some of the most pronounced declines in overall home prices since their peaks, while inventory levels continue to swell in Phoenix, and Florida is rapidly transitioning toward a buyer's market.

Overall, existing home sales experienced a 2.5% decline between July and August, settling at a seasonally adjusted annual rate of 3.86 million—marking a 4.2% decrease compared to the previous year, according to the latest data from the National Association of Realtors. This deceleration was particularly evident in the South, where existing home sales plummeted by 6% year-over-year and 3.9% from July.

Moreover, investors in these markets are likely to confront a myriad of challenges, including rapidly escalating property taxes. In Florida, the situation is exacerbated by exorbitant home and flood insurance premiums, a consequence of the increasing frequency of extreme weather events and natural disasters.

RELATED CONTENTS

US Real Estate Trends: Millennials Favor Small Towns

A new study reveals millennials and Gen Z are flocking to small towns and rural counties, reshaping the US...

UK Real Estate Trends: Buy-to-Let Landlords Thrive

Discover how 60% of buy-to-let (BTL) landlords remain optimistic amid market challenges, anticipating...

Greece’s Commercial Real Estate Market on the Rise

The Greece commercial real estate market is thriving, with a focus on office buildings and tourist...

Real Estate Selling Intentions Rise in Switzerland

New data reveals a growing willingness to sell real estate, especially in urban areas and western...

Greece real estate market: Thessaloniki Homes Now Costlier Than Athens

Discover why houses in Thessaloniki are becoming pricier than those in Athens. Explore the dynamics of the...

Global Luxury Real Estate Landscape 2024/2025: Portugal's Enduring Appeal

The global luxury real estate market remains a refuge for investors in 2024/2025, with Portugal standing...

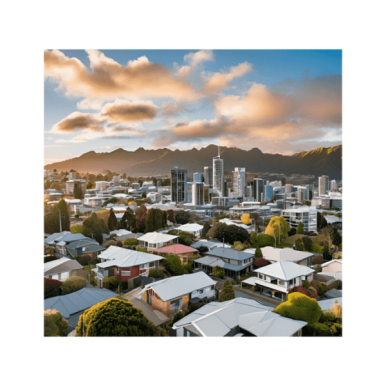

New Zealand Real Estate Market: Prices Rebound in September

After months of decline, New Zealand real estate prices rose to $823,550 in September, marking a...

Spain Real Estate Market: 3% Growth Forecast by 2025

Solvia forecasts a 3% increase in Spain’s housing prices and sales by 2025, driven by rising residential...

Portugal’s House Prices Rise Amid EU Declines

Discover how Portugal defies trends with rising house prices, contrasting sharply with declines in...