Investing in Swiss Real Estate: Risks and Rewards

Discover unique opportunities in Switzerland's rental market. Learn to invest wisely with small sums for high returns amid rising costs.

Switzerland, known for its breathtaking landscapes and high standard of living, presents a unique landscape for property investment. With 58% of its population renting, the country boasts one of the lowest home ownership rates globally. This scarcity of available properties, coupled with high prices, creates a challenging environment for potential homeowners. However, for those looking to invest in Swiss real estate, there are avenues that allow for relatively small contributions while still offering the potential for significant returns, albeit with inherent risks.

The Crowdlending Revolution

One of the most innovative ways to invest in Swiss property is through crowdlending platforms. A notable example is Raizers, a property crowdlending platform that originated in Switzerland a decade ago. Raizers has expanded its operations to seven European countries, providing investors with an accessible entry point into the real estate market. With an initial investment of just CHF1,000 (approximately $1,182), investors can expect an average return of 10% over a 24-month period. This model democratizes property investment, allowing individuals to participate in the market without the need for substantial capital.

Crowdlending not only offers attractive returns but also diversifies investment portfolios. By pooling funds from multiple investors, platforms like Raizers can finance various real estate projects, spreading the risk across a broader base. However, potential investors should remain aware of the risks associated with crowdlending, including the possibility of project delays or defaults.

Co-Ownership Opportunities

In addition to crowdlending, another innovative approach to property investment in Switzerland is through co-ownership platforms. Foxstone, for instance, allows investors to contribute CHF25,000 to become co-owners of a building. This model has gained traction, as it provides investors with a tangible asset and the potential for steady returns. Buildings financed through Foxstone generate an average return of 6%.

Since its inception six years ago, Foxstone has successfully raised over CHF250 million from approximately 22,000 investors, financing more than 60 properties. This co-ownership model not only democratizes access to real estate but also fosters a sense of community among investors, as they share in the ownership and management of the properties.

Market Dynamics and Tenant Concerns

While the prospect of earning yields of 6% or more is enticing, it has raised concerns among tenant advocacy groups, such as the Tenants’ Association. The association argues that the increasing presence of small and large landlords, crowdlending platforms, and large investment funds in the Swiss real estate market could lead to rising rents and reduced tenant protections. The market-driven logic that governs these investments often prioritizes returns over tenant welfare, prompting calls for regulatory measures to safeguard renters.

The concerns voiced by tenant advocates highlight the delicate balance between investment opportunities and the need for affordable housing. As property investment becomes more accessible, it is crucial for stakeholders to consider the broader implications of their actions on the rental market and the communities they serve.

The Role of Technology in Property Investment

The rise of technology has significantly transformed the property investment landscape in Switzerland. Platforms like Raizers and Foxstone leverage digital tools to streamline the investment process, making it easier for individuals to participate in real estate ventures. This technological shift not only enhances accessibility but also fosters transparency, allowing investors to track their investments and returns in real time.

Moreover, the use of data analytics and market research enables these platforms to identify lucrative investment opportunities, minimizing risks for investors. As technology continues to evolve, it is likely that we will see further innovations in the property investment sector, making it even more attractive to a broader audience.

Navigating Risks in Property Investment

Despite the appealing returns, investing in Swiss real estate market is not without its risks. Market fluctuations, regulatory changes, and economic downturns can all impact the performance of real estate investments. Investors must conduct thorough due diligence and remain informed about market trends to mitigate these risks effectively.

Additionally, the relatively small size of the Swiss real estate market means that investors may face challenges related to liquidity. Unlike larger markets, where properties can be bought and sold quickly, Swiss real estate transactions can take time, potentially affecting an investor's ability to access their capital when needed.

The Future of Property Investment in Switzerland

As the Swiss real estate market continues to evolve, the trend toward alternative investment models is likely to gain momentum. Crowdlending and co-ownership platforms are paving the way for a new generation of investors who seek to diversify their portfolios without the burden of traditional property ownership.

Furthermore, as awareness of these investment opportunities grows, we can expect an influx of new participants in the market. This influx could lead to increased competition, driving innovation and potentially resulting in better returns for investors.

The Swiss real estate market offers a unique landscape for investment, characterized by low home ownership rates and high rental demand. Platforms like Raizers and Foxstone have revolutionized access to real estate investment, allowing individuals to contribute relatively small amounts while still achieving significant returns. However, potential investors must remain vigilant about the risks involved and consider the broader implications of their investments on the rental market and tenant welfare. As technology continues to shape the industry, the future of property investment in Switzerland looks promising, with opportunities for both seasoned investors and newcomers alike.

RELATED CONTENTS

US Real Estate Trends: Millennials Favor Small Towns

A new study reveals millennials and Gen Z are flocking to small towns and rural counties, reshaping the US...

UK Real Estate Trends: Buy-to-Let Landlords Thrive

Discover how 60% of buy-to-let (BTL) landlords remain optimistic amid market challenges, anticipating...

Greece’s Commercial Real Estate Market on the Rise

The Greece commercial real estate market is thriving, with a focus on office buildings and tourist...

Real Estate Selling Intentions Rise in Switzerland

New data reveals a growing willingness to sell real estate, especially in urban areas and western...

Greece real estate market: Thessaloniki Homes Now Costlier Than Athens

Discover why houses in Thessaloniki are becoming pricier than those in Athens. Explore the dynamics of the...

Global Luxury Real Estate Landscape 2024/2025: Portugal's Enduring Appeal

The global luxury real estate market remains a refuge for investors in 2024/2025, with Portugal standing...

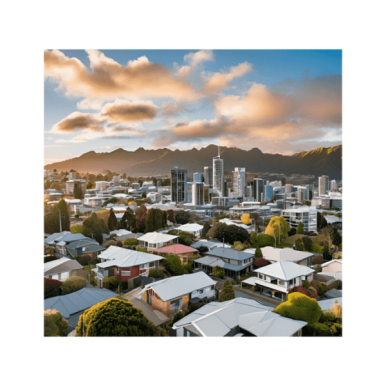

New Zealand Real Estate Market: Prices Rebound in September

After months of decline, New Zealand real estate prices rose to $823,550 in September, marking a...

Spain Real Estate Market: 3% Growth Forecast by 2025

Solvia forecasts a 3% increase in Spain’s housing prices and sales by 2025, driven by rising residential...

Portugal’s House Prices Rise Amid EU Declines

Discover how Portugal defies trends with rising house prices, contrasting sharply with declines in...