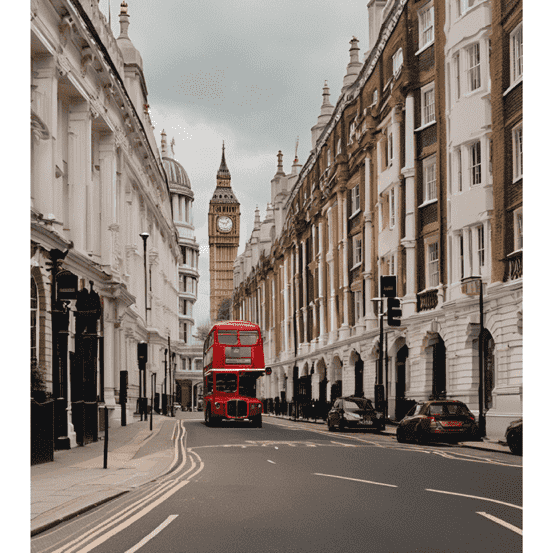

Donald Trump’s Victory May Boost London Property Demand

Knight Frank analyzes how Donald Trump’s election win could increase demand for prime London properties. Discover the potential market shifts.

Donald Trump’s recent triumph in the US Election may catalyze an uptick in demand for prime real estate in coveted locales across London, as posited by the esteemed real estate consultancy Knight Frank. Given Trump's polarizing persona, it is plausible that his presidency could prompt a migration of affluent Americans seeking refuge from his contentious policies. The anticipated inflationary pressures stemming from his economic strategies are likely to exert significant influence on the US dollar.

The electoral outcome may unveil a plethora of opportunities within the UK’s upscale residential markets. Trump’s proclivity for advocating a weaker dollar—ostensibly to bolster American competitiveness—could herald a narrowing window for overseas investors eager to capitalize on the depreciation of Sterling, which has been notably affected since the Brexit referendum of 2016. Consequently, one might witness an acceleration in acquisition plans among these international buyers.

In the aftermath of the election, a slight uptick in UK gilt yields, which serve as a barometer for mortgage rates, was observed, coinciding with a strengthening of the US dollar against the pound. This marks the commencement of Trump’s second term as President of the United States, with his inauguration set for January 20, 2025. As the geopolitical landscape evolves, the implications for both domestic and international real estate markets remain to be seen, but one thing is certain: the interplay of politics and property continues to be a captivating narrative.

RELATED CONTENTS

Greece: Europe’s Fourth Cheapest Real Estate Market

Explore why Greece stands out as one of Europe’s most economical real estate markets, attracting savvy...

Surge in Scottish Home Sales: UK Real Estate Update

Scottish home sales and enquiries surged in October, with a third of surveyors reporting the fastest growth...

Spain: A Leading Market in European Real Estate

Explore how Spain is becoming one of Europe's most promising real estate markets, excelling in retail,...

Greece Real Estate Market: Rise of Serviced Apartments

Explore the growing demand for serviced apartments in central Athens, where integrated hospitality services...

Home Prices Hit by Climate Change, J.P. Morgan Warns

J.P. Morgan analysts reveal a negative link between climate risk and home price appreciation. Explore the...

Renting in Spain: Prices Finally Decline

The cost of renting in Spain trends downwards, averaging €13/m². Discover insights on this shift after...

Canada Real Estate Market: Rents Drop for First Time in over 3 years

For the first time in over three years, average asking rents in Canada fell 1.2% in October, reaching...

Fewer Than 2% of Dutch Homes Sold to International Buyers

Analyze the decline in international purchases of Dutch houses, revealing key factors influencing this...

Lisbon: 11th City for Rising Luxury House Prices

Lisbon's luxury housing prices increased by 5.6%, outpacing Madrid, Seoul, and Zurich, marking it as a key...