Home Prices Hit by Climate Change, J.P. Morgan Warns

J.P. Morgan analysts reveal a negative link between climate risk and home price appreciation. Explore the emerging trends and their impact.

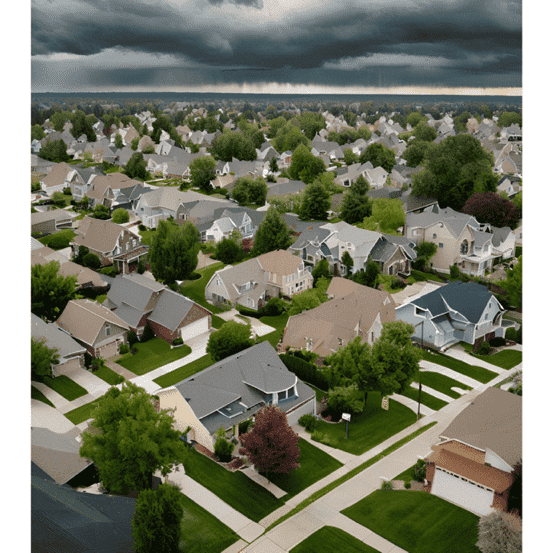

In a striking turn of events, analysts at J.P. Morgan have identified a discernible negative correlation between climate risk and the appreciation of house prices, a revelation that could reshape the real estate landscape. While home prices have soared to unprecedented heights, these valuations may be predicated on antiquated assumptions regarding climate-related risks. The analysts caution that, despite the escalating frequency and severity of natural disasters, the real estate sector has, until recently, largely neglected to incorporate the ramifications of climate risk into property valuations.

Historically, from the year 2000 onward, properties situated in areas deemed to be at higher climate risk experienced a more rapid increase in value. However, this trend has undergone a significant transformation beginning in 2023. Utilizing data sourced from the Federal Housing Finance Agency, the analysts have uncovered an emerging linkage between the risk profile of a home's location and its subsequent value growth. The findings indicate a clear negative relationship between climate risk and house-price appreciation, a paradigm shift that warrants attention.

The analysis encompassed a spectrum of climate-related hazards, including but not limited to storms, wildfires, extreme heat, flooding, rising sea levels, and drought. Notably, since the commencement of 2023, properties in high-risk areas have begun to appreciate at a slower pace compared to their counterparts in less risky locales. Cumulatively, while house prices in higher-risk regions have still outperformed those in safer areas since 2000, the data suggests that this disparity is gradually diminishing and may ultimately reverse.

In an effort to illuminate the climate-related escalations in the ongoing costs of homeownership—such as soaring insurance premiums and the increasing expenses associated with rebuilding in disaster-prone regions—companies are striving to provide prospective buyers with comprehensive climate-risk data. This initiative stems from a growing concern that consumers must be adequately informed of potential risks as they embark on one of the most significant financial commitments of their lives.

Despite these efforts, the J.P. Morgan analysts assert that the full extent of these risks has yet to be accurately reflected in current home prices. Interestingly, a trend has emerged where individuals have been gravitating toward high-risk areas of the United States rather than retreating from them. However, it appears that climate risk is finally beginning to exert its influence on home-price growth. For instance, the surging costs of home insurance have been a contributing factor in driving property values downward. The analysts noted, “It has been recently documented that property-insurance expenditures have risen sharply in riskier areas since 2020,” even when accounting for inflation.

Moreover, public awareness of climate risks is on the rise. A recent survey conducted by Redfin revealed that approximately one in five consumers who experienced the aftermath of Hurricane Helene in September are reconsidering their future relocation plans. As one respondent aptly noted, “Americans are beginning to realize that nowhere is truly immune to the impacts of climate change.” This burgeoning awareness is beginning to manifest in housing preferences, even among those who have not personally endured a catastrophic weather event. The implications of these findings are profound, suggesting a potential recalibration of the real estate market in response to the inexorable realities of climate change.

RELATED CONTENTS

Greece: Europe’s Fourth Cheapest Real Estate Market

Explore why Greece stands out as one of Europe’s most economical real estate markets, attracting savvy...

Surge in Scottish Home Sales: UK Real Estate Update

Scottish home sales and enquiries surged in October, with a third of surveyors reporting the fastest growth...

Spain: A Leading Market in European Real Estate

Explore how Spain is becoming one of Europe's most promising real estate markets, excelling in retail,...

Greece Real Estate Market: Rise of Serviced Apartments

Explore the growing demand for serviced apartments in central Athens, where integrated hospitality services...

Renting in Spain: Prices Finally Decline

The cost of renting in Spain trends downwards, averaging €13/m². Discover insights on this shift after...

Canada Real Estate Market: Rents Drop for First Time in over 3 years

For the first time in over three years, average asking rents in Canada fell 1.2% in October, reaching...

Fewer Than 2% of Dutch Homes Sold to International Buyers

Analyze the decline in international purchases of Dutch houses, revealing key factors influencing this...

Donald Trump’s Victory May Boost London Property Demand

Knight Frank analyzes how Donald Trump’s election win could increase demand for prime London properties....

Lisbon: 11th City for Rising Luxury House Prices

Lisbon's luxury housing prices increased by 5.6%, outpacing Madrid, Seoul, and Zurich, marking it as a key...