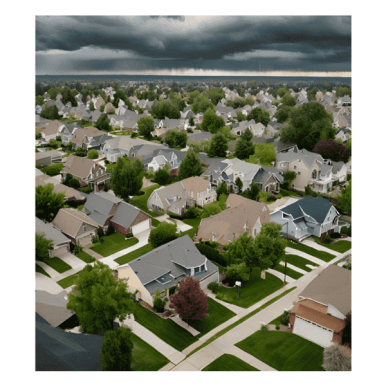

Greece Real Estate Market: Housing Supply Dwindles

Analyze the Greece real estate market as fewer houses become available for sale, influencing buyer dynamics and investment strategies.

The ongoing contraction in the inventory of residential properties available for sale in Attica has persisted into the first half of the year, plummeting to a mere 82,000 units from a staggering 150,000 just a few years prior. This phenomenon is particularly pronounced in various districts, especially those where housing prices remain within reach for the average buyer, which are now experiencing double-digit percentage declines on a year-over-year basis.

This trend can be attributed, in part, to the conclusion of the initial phase of the My Home subsidized home purchase initiative, which successfully absorbed several thousand properties in the preceding year. As a direct consequence of this dwindling supply, property prices have continued their upward trajectory, as demand remains robust. Notably, this price escalation is evident even in locales that have seen a withdrawal of foreign investors participating in the Golden Visa program, including the once-thriving downtown Athens.

Since August 2023, the city center has witnessed a complete halt in transactions involving Golden Visa investors, a situation precipitated by the steep increase in the investment threshold—from €250,000 to €500,000, and as of this month, soaring to €800,000, aligning with the rest of Attica. Nevertheless, projections indicate that, through June 2024, property prices are unlikely to stabilize; rather, they are poised to continue their sharp ascent.

Data derived from classified advertisements reveal a consistent annual decline in housing stock across all surface area categories during the January to June period, with corresponding increases in asking prices. For instance, the availability of apartments measuring up to 80 square meters has contracted by 15.8% compared to the first half of 2023, now totaling 23,428 units, while the average asking price has surged by 14.3%, reaching €2,360 per square meter.

The confluence of dwindling supply, rising prices, and shifting investment landscapes paints a complex picture of the current real estate market in Attica, one that is as perplexing as it is dynamic.

RELATED CONTENTS

Greece: Europe’s Fourth Cheapest Real Estate Market

Explore why Greece stands out as one of Europe’s most economical real estate markets, attracting savvy...

Surge in Scottish Home Sales: UK Real Estate Update

Scottish home sales and enquiries surged in October, with a third of surveyors reporting the fastest growth...

Spain: A Leading Market in European Real Estate

Explore how Spain is becoming one of Europe's most promising real estate markets, excelling in retail,...

Greece Real Estate Market: Rise of Serviced Apartments

Explore the growing demand for serviced apartments in central Athens, where integrated hospitality services...

Home Prices Hit by Climate Change, J.P. Morgan Warns

J.P. Morgan analysts reveal a negative link between climate risk and home price appreciation. Explore the...

Renting in Spain: Prices Finally Decline

The cost of renting in Spain trends downwards, averaging €13/m². Discover insights on this shift after...

Canada Real Estate Market: Rents Drop for First Time in over 3 years

For the first time in over three years, average asking rents in Canada fell 1.2% in October, reaching...

Fewer Than 2% of Dutch Homes Sold to International Buyers

Analyze the decline in international purchases of Dutch houses, revealing key factors influencing this...

Donald Trump’s Victory May Boost London Property Demand

Knight Frank analyzes how Donald Trump’s election win could increase demand for prime London properties....