Greece Real Estate Trends: The Rise of Generation Rent

Explore how rising sales prices are fueling the Generation Rent trend in Greece, as homeownership rates continue to decline.

The phenomenon of increasing rental dependency in Greece is becoming increasingly pronounced, as evidenced by the declining percentage of individuals residing in owner-occupied homes. As property sales prices continue their upward trajectory, this trend is anticipated to exacerbate in the forthcoming years. Recent data from the Geoaxis Apartment Value Observatory reveals a notable decline in the owner-occupation rate in Greece, plummeting from 75.4% prior to the pandemic in 2019 to a mere 72.8% in 2022. This 2.6% decrease translates to approximately 102,695 homes, indicating that a significant number of former homeowners opted to sell their properties without reinvesting in new ones, instead choosing the rental market.

Consequently, the proportion of renters has surged to 27.2% of the national population, a marked increase from 24.6% in 2019. Notably, urban centers such as Athens and Thessaloniki exhibit even higher rental rates, potentially exceeding 35% of their respective populations. This urban rental surge can be attributed to the fact that many homeowners are employed in these metropolitan areas, often far removed from their properties.

Moreover, a troubling trend is emerging among younger demographics, who increasingly find themselves unable to penetrate the housing market, thereby gravitating towards rental options. This phenomenon has given rise to what is colloquially termed the "Generation Rent," a cohort that is poised to dominate the housing landscape in the coming decades, not only in Greece but also in other nations characterized by high homeownership rates, such as Spain.

According to Eurostat data presented by Geoaxis, the decade spanning from January 2013 to January 2023 saw the average annual increase in basic salaries stagnate at a modest 2%. In stark contrast, the average increase in housing prices within the monitored areas—namely Maroussi, Ampelokipi, Peristeri, and Paleo Faliro—skyrocketed by an astonishing 49%. Furthermore, from the third quarter of 2022 to the third quarter of the current year, property prices in these locales surged by 24.7% for newer constructions (up to five years old) and 22.68% for older edifices.

The interplay of stagnant wages and soaring property prices is fostering an environment where renting is becoming the norm, particularly for younger generations. As the landscape of homeownership continues to evolve, it remains to be seen how this will impact the socio-economic fabric of Greece and beyond.

RELATED CONTENTS

Greece: Europe’s Fourth Cheapest Real Estate Market

Explore why Greece stands out as one of Europe’s most economical real estate markets, attracting savvy...

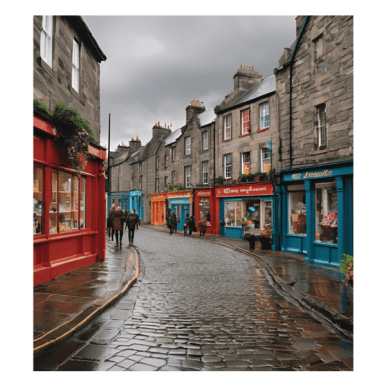

Surge in Scottish Home Sales: UK Real Estate Update

Scottish home sales and enquiries surged in October, with a third of surveyors reporting the fastest growth...

Spain: A Leading Market in European Real Estate

Explore how Spain is becoming one of Europe's most promising real estate markets, excelling in retail,...

Greece Real Estate Market: Rise of Serviced Apartments

Explore the growing demand for serviced apartments in central Athens, where integrated hospitality services...

Home Prices Hit by Climate Change, J.P. Morgan Warns

J.P. Morgan analysts reveal a negative link between climate risk and home price appreciation. Explore the...

Renting in Spain: Prices Finally Decline

The cost of renting in Spain trends downwards, averaging €13/m². Discover insights on this shift after...

Canada Real Estate Market: Rents Drop for First Time in over 3 years

For the first time in over three years, average asking rents in Canada fell 1.2% in October, reaching...

Fewer Than 2% of Dutch Homes Sold to International Buyers

Analyze the decline in international purchases of Dutch houses, revealing key factors influencing this...

Donald Trump’s Victory May Boost London Property Demand

Knight Frank analyzes how Donald Trump’s election win could increase demand for prime London properties....

.PNG)