Portugal Real Estate: Bank Appraisals Hit €1,664/m²

In August, bank appraisals for Portugal real estate rose to €1,664/m², marking an 8.2% increase year-on-year. Discover the latest trends.

In August, the median value of bank appraisals for residential properties reached a noteworthy 1,664 euros per square meter (m²), reflecting a year-on-year increase of 126 euros, or 8.2%. This figure also marks a modest rise of 26 euros, equivalent to 1.6%, compared to the preceding month of July, as reported by the National Statistics Institute (INE).

A closer examination of the data reveals that the most pronounced variation occurred in the West and Tagus Valley regions, which experienced a remarkable surge of 13.2%. Notably, no region reported a decline in appraisal values during this period. The Autonomous Region of the Azores distinguished itself with the most significant month-on-month increase of 3.5%, maintaining a trajectory of growth without any recorded decreases.

In total, approximately 31,700 bank appraisals were conducted in August, representing a slight decrease of 2.7% from July, yet showcasing a robust year-on-year increase of 29.0%. When focusing on apartments specifically, the median appraisal value soared to 1,850 euros per m², marking an impressive 8.4% increase compared to August of the previous year. The highest appraisal values were observed in Greater Lisbon, where the figure reached 2,461 euros/m², followed closely by the Algarve at 2,192 euros/m². In stark contrast, the Centre region recorded the lowest value at 1,213 euros/m².

The Autonomous Region of the Azores again stood out with a remarkable year-on-year growth rate of 13.8%, with no declines noted. When comparing to the previous month, the appraisal value of apartments saw an increase of 1.8%, with the Azores leading the charge at 4.6%, while Madeira experienced a slight dip of 0.3%.

Delving deeper into the specifics, the median appraisal value for one-bedroom apartments rose by 40 euros to reach 2,393 euros/m². Two-bedroom apartments saw an increase of 42 euros, bringing their value to 1,895 euros/m², while three-bedroom apartments experienced a rise of 23 euros, culminating in a value of 1,642 euros/m². Collectively, these categories accounted for an impressive 93.0% of all apartment appraisals conducted in August.

Turning our attention to houses, the median appraisal value stood at 1,297 euros/m², reflecting an 8.4% increase compared to August 2023. The highest values for houses were similarly recorded in Greater Lisbon at 2,420 euros/m² and the Algarve at 2,388 euros/m², while the Centre and Alentejo regions reported the lowest values at 1,019 euros/m² and 1,028 euros/m², respectively. The Autonomous Region of Madeira exhibited the highest year-on-year growth at 25.3%, whereas Alentejo lagged behind with a mere 0.8% increase.

In terms of month-on-month changes, the appraisal value of houses rose by 1.2%, with the Azores again showcasing the highest growth at 3.0%, without any recorded declines. The median value for two-bedroom homes increased by 26 euros to 1,301 euros/m², three-bedroom homes saw a rise of 16 euros to 1,266 euros/m², and four-bedroom homes experienced a modest increase of seven euros to 1,360 euros/m². Together, these categories constituted 88.8% of the home appraisals conducted during the analyzed period.

In a broader context, regions such as Greater Lisbon, the Algarve, the Autonomous Region of Madeira, the Setúbal Peninsula, and the Alentejo Coast boasted appraisal values exceeding the national median by 47.6%, 33.9%, 15.9%, 13.3%, and 10.3%, respectively. Conversely, the regions of Alto Alentejo, Beiras and Serra da Estrela, and Alto Tâmega and Barroso reported the lowest values in relation to the national median, with staggering deficits of -50.4%, -46.2%, and -45.9%, respectively.

The appraisal landscape in August paints a picture of resilience and growth across various regions, with notable disparities that reflect the intricate dynamics of the Portugal real estate market.

RELATED CONTENTS

Greece: Europe’s Fourth Cheapest Real Estate Market

Explore why Greece stands out as one of Europe’s most economical real estate markets, attracting savvy...

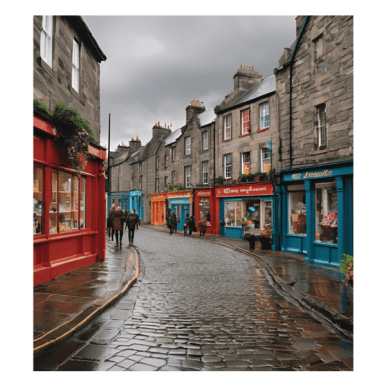

Surge in Scottish Home Sales: UK Real Estate Update

Scottish home sales and enquiries surged in October, with a third of surveyors reporting the fastest growth...

Spain: A Leading Market in European Real Estate

Explore how Spain is becoming one of Europe's most promising real estate markets, excelling in retail,...

Greece Real Estate Market: Rise of Serviced Apartments

Explore the growing demand for serviced apartments in central Athens, where integrated hospitality services...

Home Prices Hit by Climate Change, J.P. Morgan Warns

J.P. Morgan analysts reveal a negative link between climate risk and home price appreciation. Explore the...

Renting in Spain: Prices Finally Decline

The cost of renting in Spain trends downwards, averaging €13/m². Discover insights on this shift after...

Canada Real Estate Market: Rents Drop for First Time in over 3 years

For the first time in over three years, average asking rents in Canada fell 1.2% in October, reaching...

Fewer Than 2% of Dutch Homes Sold to International Buyers

Analyze the decline in international purchases of Dutch houses, revealing key factors influencing this...

Donald Trump’s Victory May Boost London Property Demand

Knight Frank analyzes how Donald Trump’s election win could increase demand for prime London properties....