Spain's Housing Investment Surge Amid Rental Market Challenges

Explore the rise of 'triple rental' investments in Spain, driven by new laws and secure returns despite ongoing rental market challenges.

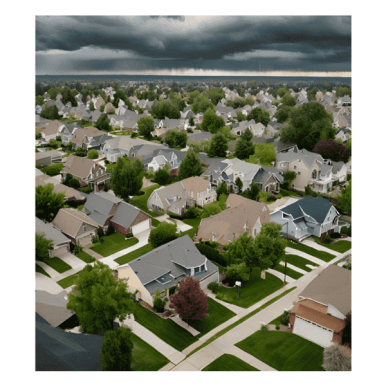

In the midst of the persistent tribulations besieging the rental market, Spain is experiencing a remarkable resurgence in housing investment, a phenomenon that has been notably intensified by the recent enactment of the Housing Law. For astute investors seeking secure returns through real estate, this burgeoning wave of investment is proving to be exceedingly alluring. El Economista has highlighted the rising prominence of an innovative investment paradigm referred to as “triple rental.”

Traditionally, the pathway to upgrading one’s living situation has involved divesting one’s current property to facilitate the acquisition of a larger abode. However, the financial and tax implications associated with this conventional approach have rendered it increasingly unattractive. Enter the “triple rental” model—a groundbreaking investment strategy that is rapidly gaining traction across Spain.

So, what exactly does “triple rental” entail? As elucidated by Jesús Martí, the director of large accounts at Alquiler Seguro, this model encompasses three pivotal operations. “First, one rents a property that aligns with their current living requirements, thereby assuming the role of a tenant. Second, the individual leases out their existing residence. Finally, the capital conserved from eschewing the purchase of a larger home, along with the associated expenses, is strategically allocated to acquire a third, more economically viable property intended for investment purposes. Ideally, this investment property is situated outside the urban center, allowing the owner to generate income without compromising their financial liquidity.”

To illustrate this model, consider a couple in Madrid anticipating the arrival of a child and consequently in need of a more spacious dwelling. Rather than plunging into the real estate market with a hefty €525,000 purchase, which would also necessitate an additional €65,000 for renovations, they opt to rent a comparably sized apartment for €1,600 per month. Concurrently, they lease their current home for €1,200 monthly, effectively reducing their net expenditure for a larger living space to a mere €400. The financial surplus accrued from forgoing the purchase of a new residence is then judiciously invested in a smaller, more affordable property in Oviedo, priced at €88,400. This new investment property is subsequently rented out for €560 per month, thereby alleviating their rental obligations in Madrid. Consequently, the couple can enjoy the benefits of a larger home while simultaneously owning two properties—one designated for investment—without straining their financial resources.

Is this an opportune moment to invest in real estate? Industry experts assert that the current climate is indeed favorable for property investment. The recent interest rate reductions by the European Central Bank have fostered a conducive environment for prospective buyers. There has been a notable influx of new entrants into the market, with the proportion of investors nearly doubling from 7% to 13% over the past year. Real estate is increasingly perceived as a stable and resilient asset, rendering it an attractive avenue for long-term wealth accumulation. Despite the constrained housing supply, this scarcity presents certain advantages, as the heightened demand for rental properties is propelling rental yields. Nationally, the average return on investment for rental properties hovers around 6.4%, with certain locales offering even more lucrative returns, particularly in regions where property prices have remained stable while rental rates have surged.

Emerging trends in property investment extend beyond the triple rental model. The growing inclination towards shared investment strategies is reshaping Spain’s property landscape. Rather than acquiring entire properties, investors are increasingly pooling their resources to co-invest in higher-value real estate, thereby circumventing the complexities associated with property management. This shift signifies a departure from the traditional practice of purchasing properties in close proximity to one’s residence to mitigate risk; investors are now broadening their horizons. By sharing the investment burden and outsourcing property management, individuals can reap the financial rewards of rental income and capital appreciation without the encumbrance of hands-on management.

RELATED CONTENTS

Greece: Europe’s Fourth Cheapest Real Estate Market

Explore why Greece stands out as one of Europe’s most economical real estate markets, attracting savvy...

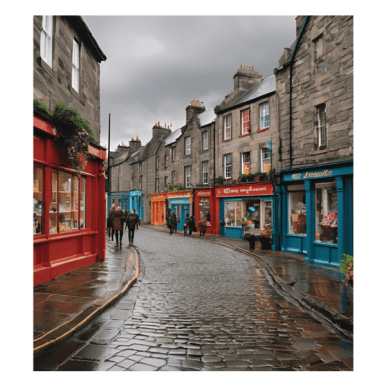

Surge in Scottish Home Sales: UK Real Estate Update

Scottish home sales and enquiries surged in October, with a third of surveyors reporting the fastest growth...

Spain: A Leading Market in European Real Estate

Explore how Spain is becoming one of Europe's most promising real estate markets, excelling in retail,...

Greece Real Estate Market: Rise of Serviced Apartments

Explore the growing demand for serviced apartments in central Athens, where integrated hospitality services...

Home Prices Hit by Climate Change, J.P. Morgan Warns

J.P. Morgan analysts reveal a negative link between climate risk and home price appreciation. Explore the...

Renting in Spain: Prices Finally Decline

The cost of renting in Spain trends downwards, averaging €13/m². Discover insights on this shift after...

Canada Real Estate Market: Rents Drop for First Time in over 3 years

For the first time in over three years, average asking rents in Canada fell 1.2% in October, reaching...

Fewer Than 2% of Dutch Homes Sold to International Buyers

Analyze the decline in international purchases of Dutch houses, revealing key factors influencing this...

Donald Trump’s Victory May Boost London Property Demand

Knight Frank analyzes how Donald Trump’s election win could increase demand for prime London properties....