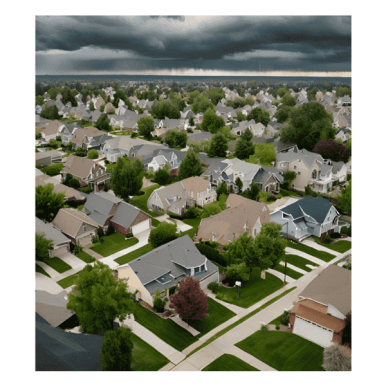

US Housing Market Sees Highest Inventory Since 2019

The US housing market experiences a surge in inventory as sellers flood the market, marking the highest levels since 2019. Discover the implications.

The housing market is experiencing a notable shift, providing prospective buyers with a much-needed respite. After enduring a tumultuous two-year period characterized by soaring prices and dwindling inventory, the current landscape reveals a significant uptick in available homes, reaching levels not seen since 2019. This resurgence has ignited a flicker of optimism among beleaguered buyers nationwide.

In October alone, the inventory of homes surged by an impressive 29.2% compared to the previous year, marking a full year of consistent growth in listings. Homeowners across the country are enthusiastically placing “For Sale” signs in their yards, particularly in regions that were once pandemic hotspots, such as Austin, Memphis, and Orlando. These so-called “boomtowns” are experiencing a remarkable revival, with Austin's inventory skyrocketing by an astonishing 40.1%. Meanwhile, Memphis and Orlando have also reported substantial gains of 39.2% and 26.6%, respectively.

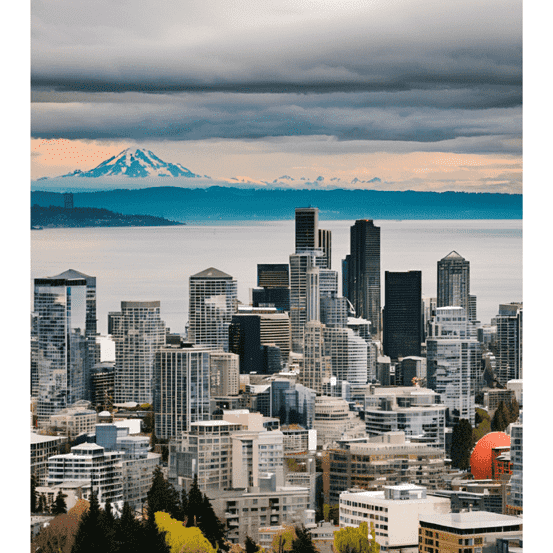

This inventory expansion is not confined to the southern states; it is a nationwide phenomenon, with the western region trailing closely behind at a commendable 33.6% increase, followed by the Midwest and Northeast. Fresh listings are also on the rise, with the West witnessing a 7.0% increase in newly listed homes compared to October of the previous year. Noteworthy markets such as Baltimore, Washington D.C., and Seattle are leading this charge, with newly listed homes experiencing remarkable jumps of 24.9%, 19.4%, and 17.5%, respectively.

Despite this influx of new inventory, home prices have exhibited remarkable stability, with the national median price remaining steadfast at $424,950—unchanged from last October. However, when one considers the shift in inventory towards smaller homes, it becomes evident that the typical home listed this year commands a higher asking price compared to its predecessor. While the overall sticker price may appear stable, the price per square foot tells a different story, having escalated by 2.1% year-over-year and an astonishing 50.5% since 2019.

On a more positive note, the increase in available choices has alleviated the pressure on buyers to make hasty decisions. Homes are now languishing on the market for an average of 58 days—an entire week longer than the previous year and the slowest pace observed since 2019. This extended timeframe allows buyers to deliberate thoughtfully, rather than succumbing to the frantic pace that characterized the market in recent years.

RELATED CONTENTS

Greece: Europe’s Fourth Cheapest Real Estate Market

Explore why Greece stands out as one of Europe’s most economical real estate markets, attracting savvy...

Surge in Scottish Home Sales: UK Real Estate Update

Scottish home sales and enquiries surged in October, with a third of surveyors reporting the fastest growth...

Spain: A Leading Market in European Real Estate

Explore how Spain is becoming one of Europe's most promising real estate markets, excelling in retail,...

Greece Real Estate Market: Rise of Serviced Apartments

Explore the growing demand for serviced apartments in central Athens, where integrated hospitality services...

Home Prices Hit by Climate Change, J.P. Morgan Warns

J.P. Morgan analysts reveal a negative link between climate risk and home price appreciation. Explore the...

Renting in Spain: Prices Finally Decline

The cost of renting in Spain trends downwards, averaging €13/m². Discover insights on this shift after...

Canada Real Estate Market: Rents Drop for First Time in over 3 years

For the first time in over three years, average asking rents in Canada fell 1.2% in October, reaching...

Fewer Than 2% of Dutch Homes Sold to International Buyers

Analyze the decline in international purchases of Dutch houses, revealing key factors influencing this...

Donald Trump’s Victory May Boost London Property Demand

Knight Frank analyzes how Donald Trump’s election win could increase demand for prime London properties....